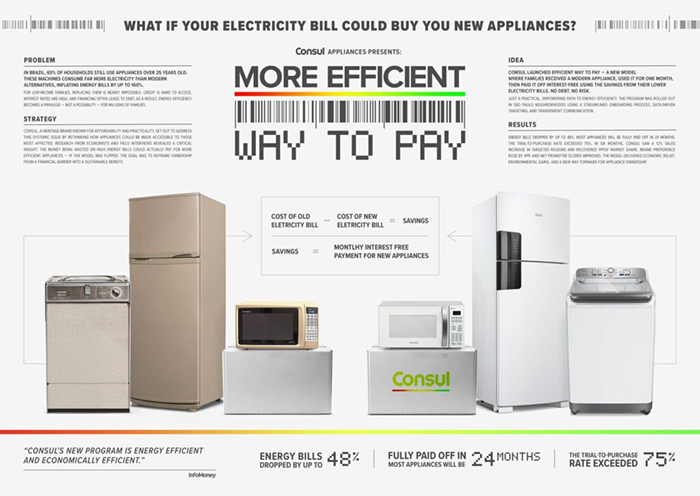

As of the closing price on September 23, 2024, APR’s market capitalization (5.3756 trillion KRW) surpassed that of LG Household & Health Care (5.3336 trillion KRW) for the first time. This was a symbolic moment signaling a shift in the Korean beauty industry. The market’s evaluation wasn’t based on mere expectations, but rather grounded in explosive, data-driven performance. Let’s take a look at the numbers. Operating profit in 2022 was 39.2 billion KRW. In 2023, it jumped to 104.1 billion KRW—more than doubling in just one year (approximately 165% growth). And the momentum continues in 2025, with first-half sales reaching 593.8 billion KRW, a staggering 95% increase from the same period last year. Total operating profit in the first half of this year has already hit approximately 149.4 billion KRW, surpassing last year’s annual total.

APR has proven to deliver industry-leading performance and growth that is difficult for its competitors to match. While traditional beauty companies are struggling due to overreliance on the Chinese market and limitations of wholesale distribution structures, APR has quickly risen to threaten these incumbents. Defined as a “beauty tech” company, APR focuses on cosmetics, health supplements, and at-home beauty devices. At the core of its exponential growth is the brand Medicube, particularly the 2021 launch of its home beauty device line, AGE-R, which served as the company’s breakout moment.

< Image Source: APR >

How did it all begin?

Kim Byung-hoon, born in 1988 and founder & current CEO of APR, enrolled at Yonsei University as a business major. After witnessing his father’s job loss in middle school, Kim realized that one could be let go not because of a lack of skill but due to office politics. That moment sparked a conviction in him: “I’ll build a company I can control.” However, his entrepreneurial path wasn’t a straight line to success. Before APR, Kim had five failed ventures, including a virtual fitting service (IF:DA), a dating app (Gilhana Sai), an alarm app, a couple-challenge app, and a social commerce platform. These failures taught him an important lesson: “There’s usually a reason why no one else is doing something—blue oceans can be dead oceans.” After experiencing the power of branding through ad agency work, Kim grew frustrated watching customers churn due to the poor quality of the products he was advertising. That’s when he decided, “I’ll make it myself.” This resolve led to the founding of Innoventures in 2014, APR’s predecessor, and the launch of the skincare brand AprilSkin with its first product: a natural soap called Magic Stone.

< Image Source: APR >

In the early days, Kim operated multiple brands including fashion brand NERDY, beauty brands Forment, and Glam.D. However, he soon realized the need for focus. “To become a global company, one of our brands needs to become like Apple,” he stated. This led him to consolidate efforts into Medicube, and in 2021, launch its AGE-R beauty device line. This decision proved critical to the company’s current explosive success, driven by three major strategies:

1. First-Mover Advantage in the Home Beauty Device Market (The AGE-R Ecosystem)

The key driver of APR’s success is clearly the Medicube AGE-R home beauty devices. Starting with the Booster Healer in 2021, APR entered the beauty device market with reasonable pricing between 200,000 to 300,000 KRW, quickly securing a foothold. As of June 2025, global cumulative sales have surpassed 4 million units. In the past five months alone, a device sold every 13 seconds on average. But APR’s real strategy lies not in the device itself, but in selling high-margin cosmetics (consumables) that are used with the devices—effectively “locking” customers into its ecosystem.

2. Optimization of the D2C Model and a High-Profit Structure

A pillar of APR’s success is its optimized D2C (Direct-to-Consumer) model. For seven years since its founding, the company focused on running its own online store, generating over 70% of its sales through this channel. This strategy eliminated intermediaries and maximized gross profit margins. As of the latest 12-month period (TTM), APR’s gross margin reached 75.06%—a figure that competitors can hardly replicate. Moreover, APR positions itself not just as a retailer, but as a “data-driven commerce tech company.” With its mission to “Advance People’s Real Life,” APR uses vast sales data accumulated from its own online store to inform product development and marketing. Since the second half of 2019, APR has strengthened its IT division by recruiting top developers from Naver and Woowa Brothers, laying the groundwork for influencer marketing and review-based strategies tailored to Gen Z and Millennials.

3. A “Beyond China” Strategy and Global Market Penetration

APR’s global strategy departs from the traditional K-beauty playbook, which focused heavily on the Chinese market. Instead, APR has successfully entered developed markets like North America and Japan using a direct-to-consumer approach. By offering reasonable pricing and skin-problem-solving solutions, APR’s Medicube ranked No.1 in Amazon U.S. beauty category search traffic in May 2025, recording 404,749 searches. As of Q2 2025, overseas sales accounted for a staggering 78% of APR’s total revenue—clear evidence of its global revenue restructuring. In Japan, Medicube’s May sales increased 319% year-over-year, showcasing both market diversification and structural stability.

Looking back on APR’s journey, it’s clear that the current success was built upon a foundation of repeated failures. Still, some critics caution that the technology behind home beauty devices isn’t that complex and that APR may be too heavily reliant on AGE-R. While the future remains uncertain, one thing is clear: the rise of a Korean brand on the global stage is something worth rooting for.